And why your business needs both

Although you could group us all as number nerds, I feel it’s important to clear up the differences between a bookkeeper and an accountant.

As a qualified bookkeeper, clients ask why they need my services as well as those of an accountant. I can’t stress highly enough that we are both an integral part of your business.

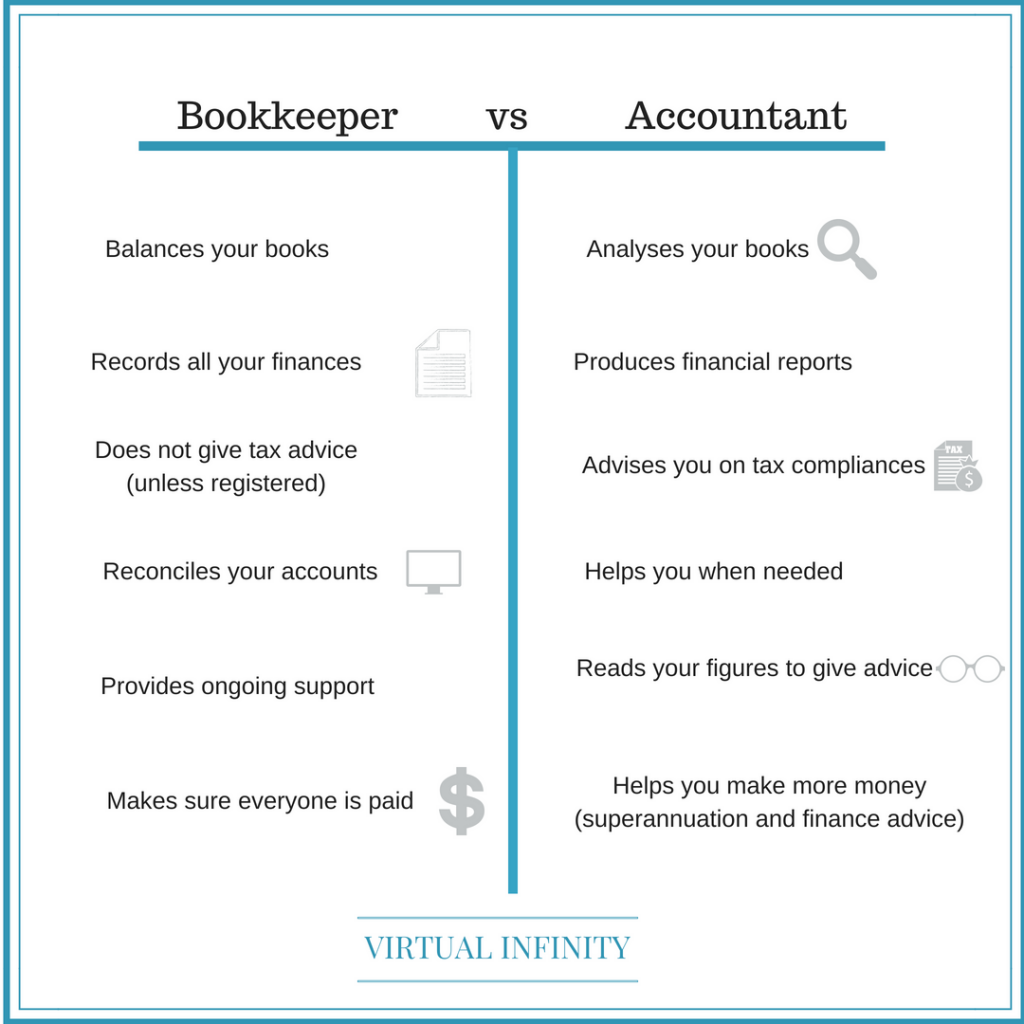

While what we do can have some overlap, a bookkeeper (like me) is the person who helps you with the ongoing financial recording and transactions to keep your business running smoothly. Your accountant comes into play after I’ve done your books. They analyse your finances and are the best person to give you advice on tax requirements.

To help you understand the benefits of having both a bookkeeper and an accountant, here are some of the tasks we both do.

The benefits of a bookkeeper and an accountant

What your bookkeeper will do

Bookkeepers are a must for the ongoing financial health of your business. They make sure all your invoices are sent and paid, that your bank accounts are balanced and that all your expenses are recorded. They will know what your numbers are saying and can provide you with general advice on where your business is making or losing money.

Typical tasks include:

- Recording transactions

- Posting journals

- Processing payroll

- Preparing and sending invoices

- Paying bills

- Recording payments

- Reconciling bank accounts

- Preparing internal reports

- Making sure your figures are complete and accurate for the accountant

What your accountant will do

Although an accountant could do everything a bookkeeper does (and charge more!), businesses are best to use them for the advisory or analytical side of their finances. They are experienced at looking at your numbers and based on past performance; they’ll be able to give you advice on the future financial stability of your business. They are also the best people to give you advice on taxation matters.

Typical tasks include:

- Being up to date with the latest tax laws

- Providing advice on how to manage your tax

- Helping you prepare budgets and cash flow forecasts

- Preparing statutory financial reports and tax returns

- Superannuation fund advice

- Financial management advice

Do you use a bookkeeper and an accountant?

I encourage all business owners to see their bookkeeper and their accountant as vital team members who work together for the financial health of your business. Your accountant will rely on your bookkeeper to give them accurate books, so make sure you introduce them so that they can communicate. Clear communication eliminates mistakes and allows your accountant to use the information prepared by your bookkeeper to give you the complete financial picture of your business.

I’d love for you to share your thoughts in the comments on whether you use a bookkeeper, an accountant or both. And why?

Trackbacks/Pingbacks